How to manage an innovation funnel? (part 2)

In a previous blogpost I summarised the key topics covered in my coffee chat on innovation portfolio management with the Chief Digital Officer of an ASX100 consumer goods company.

We discussed how leaders should act more like venture capitalists when it comes to managing the innovation portfolio:

- making many small investments at the beginning,

- investing further only on ideas, initiatives and projects that show potential,

- cutting off the ones that do not before they waste too much money and valuable resources.

In this blog post I will summarise the second part of our discussion on the key governance principles to manage an innovation portfolio successfully.

Metered funding

Let’s consider discovery, validation and acceleration as the typical phases in an innovation project. The discovery phase should enable the exploration of a large number of ideas. Validation should help reduce the uncertainty of new business ideas with solid testing. Acceleration should facilitate the rapid growth of tested business models with high potential. We talked about the common ‘kill ratio’ at each phase and it came as a surprise to her. Around 80% of ideas explored in discovery should be killed in this phase. Around 80% of projects in validation phase should be killed in this phase. I clarified that this is not an absolute rule, but more of a useful guide to maintain a healthy portfolio.

Other interesting characteristics at each phase can be found in the table below.

Source: Testing Business Ideas book, by Strategyzer

I spoke to her about how metered funding for teams acts as a powerful guard rail against too much waste in the innovation portfolio. It consists of providing just enough funding for teams to test the most critical hypotheses in the phase they are in, but no more.

Decision making

As she was imagining herself making those decisions, we went through the three criteria that executives overseeing an innovation portfolio can base their decision on:

• Strategic fit.

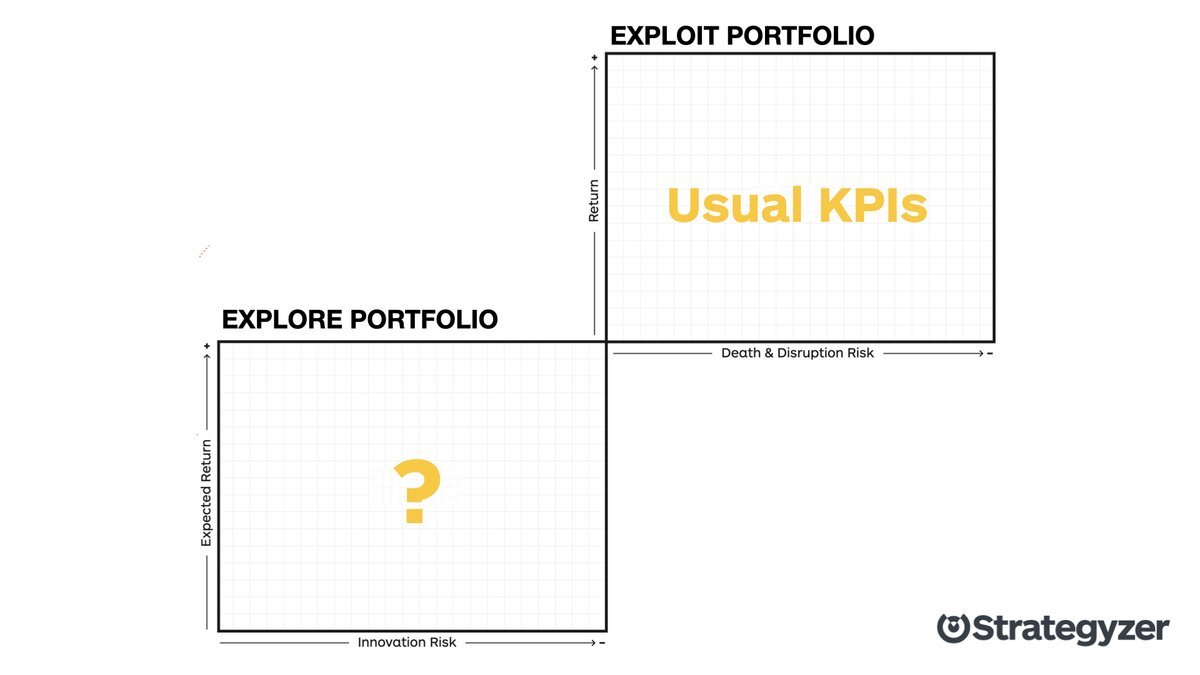

• Opportunity size: the expected return of an initiative as visualized on the vertical axis of the Strategyzer portfolio map.

• Evidence: the evidence brought by the team (progress) as visualized on the horizontal axis of the portfolio map.

We discussed how the decision and selection headache is actually resolved by the portfolio approach, as good ideas will emerge on the portfolio map and poorly performing teams will drop off.

Intrapreneurship

She wondered where all those innovation teams came from. To answer that I went through a concrete example: the high level actions taken by a global pharmaceutical company ($45bn+ revenues) that we work with at Strategyzer. To feed their growth innovation portfolio, this company started an intrapreneurship support program.

Definition: Intrapreneurship is the act of behaving like an entrepreneur while working within a large organization.

Twice a year, they manage an application process where global intrapreneur teams can submit their new business ideas. Successful applicants enter a 3-month program to explore their business idea. The intrapreneurship support program is designed by the corporate innovation team to facilitate the discovery phase and includes metered funding, skills development and expert coaching.

Teams that survive the discovery phase can access further funding and coaching. Strategyzer supports the validation phase for those teams with our innovation sprint that helps teams drastically reduce the uncertainty of their business ideas with 10-12 weeks of intense testing and high impact coaching. A few successful teams achieve a tested business model and are ready for acceleration. Even though this stage can seem closer to execution (a task that large organizations usually excel at) there are still critical obstacles to overcome then to scale successfully.

Unfortunately, we had to slow down at the point of acceleration, as we ran out of time. What a great place to pick up our next conversation though!

A quick recap on key principles for managing an innovation portfolio that leaders should be aware of:

Use metered funding.

Make portfolio decisions based on strategic fit, opportunity and evidence.

Empower intrapreneurs to go through discovery, validation and acceleration of new business ideas.

What are your key questions on innovation and business transformation?

Note: an earlier version of this post was originally published on the Strategyzer blog