Predicting the ROI of Innovation

Anyone involved in corporate innovation will face the challenge of “selling innovation” to the executive team and/or the Board of Directors. In the last 18 months, the question of the return on investment (ROI) of innovation has kept popping up in our client work. It’s also been the question on everyone’s mind in our Australian Corporate Innovation community. And still no one has cracked it.

Predicting the ROI of innovation can feel like threading a needle in the dark. But while pinpoint precision is indeed out of our grasp, could there be a way to calculate a rough order of magnitude ROI of innovation?

In this article I want to shed light on two essential frameworks and two critical data points that could transform your perspective on innovation ROI.

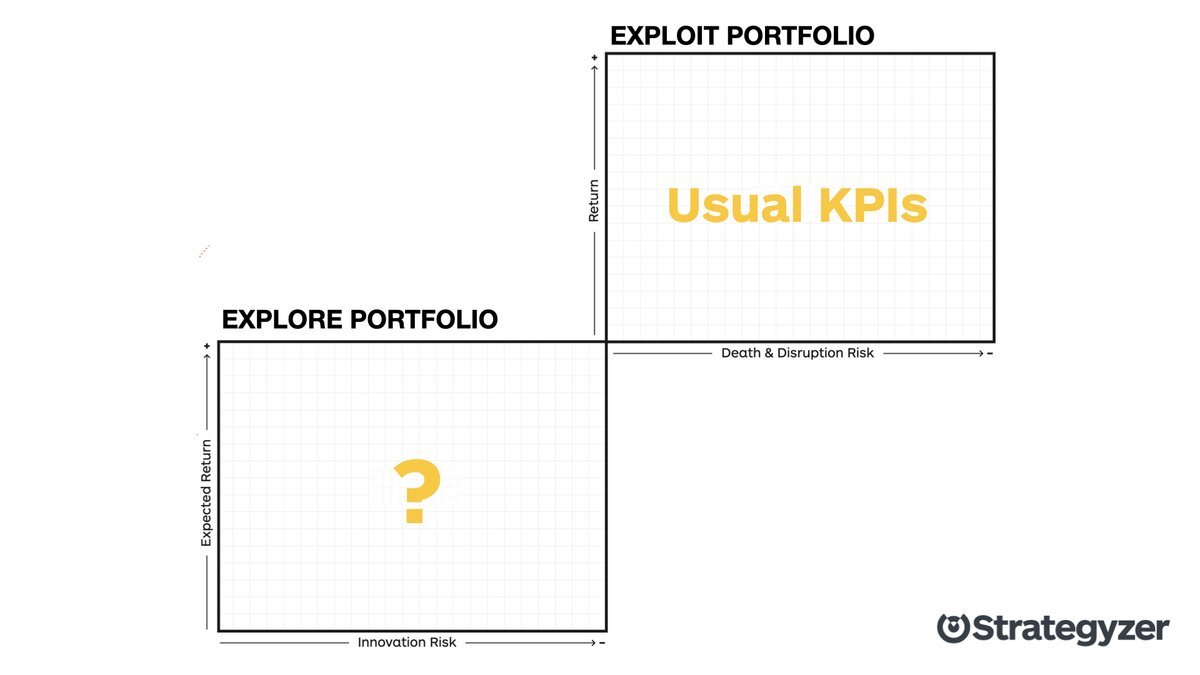

Framework #1: Explore and Exploit

Here’s a 2 min video introducing the Explore and Exploit continuum.

Why does it matter in the context of ROI? In the Exploit realm, ROI calculations are pretty straightforward. However, in Explore, where uncertainty is high and failure is part of the journey, ROI can’t be assessed at the project level. Calculating ROI requires a portfolio-level approach, acknowledging that most innovation projects will fail while only a few will flourish. The few outsized winners will compensate for the investment in retired projects in the portfolio.

Framework #2: The three types of innovation

Here’s another short video introducing the three types of innovation.

Again, why does it matter in the context of ROI? Because each of those three types of innovation has a different uncertainty level, which means a different success rate and a different time horizon to bear fruits.

Understanding these differences is key to building an ROI simulator able to adapt to the balance of innovation initiatives in an organisation.

In a recent article, my friend and colleague Tendayi Viki argues that ROI is the only thing that matters in innovation and illustrates the importance of these frameworks to calculate it.

Now that we’ve covered the fundamental ideas, let’s get to our next challenge to build an ROI simulator: benchmarks to feed our calculation engine.

For instance, what success rate should we assume for innovation projects?

As we’ve already seen, the success rate should be different depending on the type of innovation. For efficiency innovation projects close to a company’s core business, it’s not that hard to assess the success rate. It should be equivalent to the success rate of past projects in the organisation. And if you don’t have access to that information and you just want a rough order of magnitude ROI simulation, you could even assume a success rate of 100%. Indeed, despite the unavoidable complications along the way, the delays and cost overruns, failure is often not an option and almost 100% of efficiency initiatives should reach the finish line.

At the other end of the spectrum, it’s much harder to estimate the success rate of transformative initiatives outside the core business of an organisation. There’s often no data available inside an organisation on past transformative projects and very limited public data. One data point we can use comes from Bosch’s Accelerator Program, a case featured in The Invincible Company book.

The success rate of their transformative innovation initiatives happens to be below 10%. Indeed, in transformative innovation, failure is the rule, at least for 90% of initiatives.

So, for a rough order of magnitude ROI simulation you could assume a success rate of 10% for transformative innovation.

Next question: Those new products, services, and businesses that make it to the market, how much revenue will they generate?

If we use the below data point from a recent McKinsey report we learn that of all new businesses launched on the market, only 19% will generate more than $50M annual revenues after 4 years. So, for a rough order of magnitude ROI simulation I would assume only one in five launched products, services or businesses will grow annual revenues to $50M in 4 years, and we can ignore the revenues from the four other businesses.

So, for a rough order of magnitude ROI simulation you could assume only one in five launched products, services or businesses will grow annual revenues to $50M in 4 years, and ignore the revenues from the four other businesses.

What if we combined those available data points from Bosch and McKinsey? We could try to estimate the ROI of Bosch’s Accelerator Program and build a first rough prototype of an ROI simulator for transformative innovation. Given prototyping and experimenting is how we learn in innovation, what could we learn here?

Disclaimer: I have no detailed knowledge of the ROI of Bosch’s Accelerator Program. And I realise that I’m creating a Frankenstein monster by combining two different data sets. My intent here is just to show how to leverage prototyping to learn, build a rough order of magnitude ROI simulator for transformative innovation, and see if we can draw some insights that could apply to other organisations investing in transformative innovation, like Bosch.

In the below chart I have calculated innovation ROI with the following formula:

Innovation ROI = Cumulated revenues from new products, services and businesses / portfolio costs.

So, what insights popped out of the data?

Insight #1: A “bad investment” the first 4 years

The investment in a transformative innovation program as a vehicle to achieve new growth objectives would most likely look like a “bad investment” for 4 full years. The first couple of years are the worst: high costs and absolutely no revenues. By the end of year 3, every dollar spent in this program has only created 20 cents of new revenues. Not exactly the investment of the century seen from the vantage point of the CFO. And that’s the main reason why most corporate innovation programs focused on transformative ideas (i.e. outside of the core business) struggle to survive past three years. Boards and shareholders just don’t have the patience.

Insight #2: A tipping point in year 5

If such an innovation program manages to survive the Death Valley of those first few years, a tipping point can be expected in year 5. At that point it would have generated 1.5 dollars of new revenue for every historical dollar invested.

Insight #3: Patience will be rewarded

Transformative innovation is a volume game. It’s also a game that requires patience… 5 years as an absolute minimum. And after 10 years of continuous investment in transformative innovation every dollar invested should generate 10+ dollars of new revenue.

Of course, we intuitively know that innovation takes time and in a 2022 article named “What you should know about innovation’s time to impact” I concluded with the below paragraph:

“To paraphrase the famous Internet meme on planting a tree, the best time to start building your company’s innovation ecosystem was 10 years ago. That could sound like bad news. But the good news is that the second-best time is now.”

Now I fully realise that the above quote might not be enough to win the support of your Executive team and/or Board of Directors. However, backed up by numbers it might.

So, it’s time to collect your data set, build your own innovation ROI simulator and get better equipped to sell corporate innovation with the strongest arguments: guaranteed new revenue streams that can contribute to the organisation’s growth objectives.

But there’s a catch. No more stop and go every 2-3 years. The ROI rewards only come to those who play the long game with transformative innovation. If you can’t play the game with at least a 5 year mindset, then the numbers tell us that perhaps you shouldn’t play the game at all.

Note: an earlier version of this post was originally published on the Vibrance blog